Are you considering buying your first home? Homeownership is an exciting part of life that can be representative of your hard work.

Homeownership can increase your overall net worth, provide you with attractive tax shelters, and provide you with security and a greater sense of well-being. But, it also typically means taking on a large amount of debt in the form of a mortgage, which—if you’re a doctor—can add to the large sum of debt you already have from student loans.

Learning about home loans can seem like a huge task because there are many different types of mortgages, complex down payment requirements, and a number of qualifications. It’s important to understand the basics, so you can make an informed decision when jumping into home ownership for the first time.

What is a mortgage?

A mortgage allows you to purchase a home or other real estate without having all the money upfront.

According to the Consumer Financial Protection Bureau, the definition of mortgage is “an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you’ve borrowed plus interest.”

What is the difference between a loan and a mortgage?

Mortgages are secured loans that are tied to real estate, like land or a home. A mortgage is a type of loan, therefore it is always a loan, but a loan isn’t always a mortgage.

What are the different parts of a mortgage loan?

When you make your monthly mortgage payment, it is split into four parts: principal, interest, taxes and insurance (PITI).

- Principal is the portion of your loan balance that is paid down with each payment.

- Interest is the added charge per month you owe in addition to principal that is based on the interest rate, or note rate, of the loan you agreed to when you signed your loan documents with your lender.

- Taxes are 1/12 of your annual property tax bill that you will pay each month.

- Property insurance is required by lenders to cover the risk of fire, theft and other events.

How does a mortgage loan work?

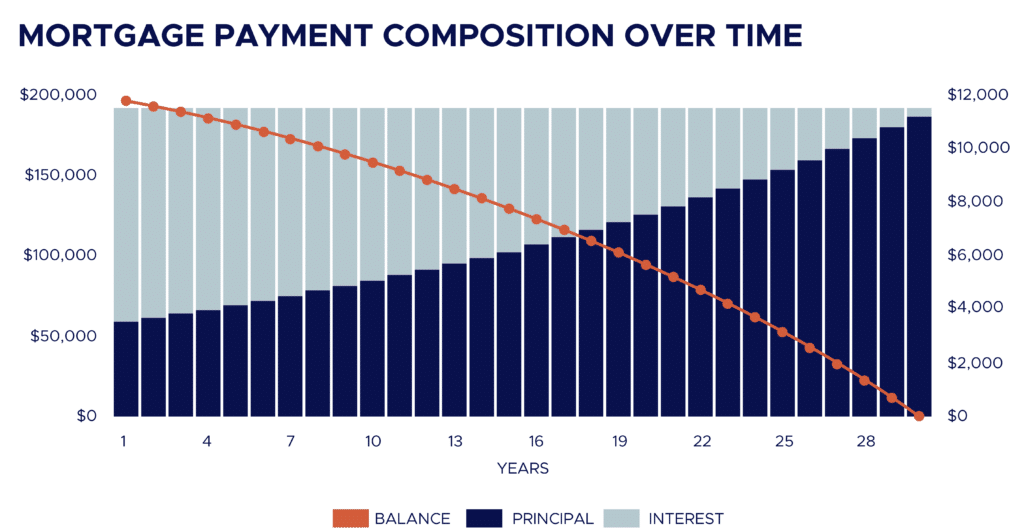

Early in your payments, interest will make up a large portion of each payment, but over time, you will begin paying more of the principal, until the balance is fully paid off, generally after 15 or 30 years.

How are mortgage interest rates determined?

Mortgage rates are determined by a number of factors based on both the individual borrower and the economy at the time of lending.

Factors that are based on the borrower include:

Credit score: Interest rates are lowest for borrowers with credit scores of 740 or higher. In our experience, borrowers with credit scores below 640 typically have much higher interest rates and fewer lending options.

Loan-to-value ratio: This is a measure of loan amount compared to the home’s value. If you make a $20,000 down payment on a $100,000 home, your mortgage will be $80,000. This means you’re borrowing 80% of the property’s value.

A loan-to-value ratio greater than 80% is typically considered high and represents a greater risk to the lender, which may increase your interest rate or increase the need for mortgage insurance. Mortgage insurance is an insurance policy that protects a mortgage lender or titleholder if the borrower defaults on payments, passes away, or is otherwise unable to meet the contractual obligations of the mortgage. It is important to note that this is insurance that protects the lender, not the borrower. In other words, you are paying an expense to protect the mortgage lender.

Certain lenders understand that many early-career doctors can’t provide a down payment and offer doctor mortgages. These physician loans don’t require a down payment and allow physicians the ability to buy a home earlier than they could with a conventional loan.

Other factors that affect your mortgage interest rate include:

Economic factors: Factors like inflation, rate of economic growth, the Federal Reserve’s monetary policy, the bond market and housing market conditions all have varying impacts on mortgage rates. Investopedia breaks down these five factors into greater detail.

How does mortgage pre-approval work?

Mortgage pre-approval gives you the ability to see how much a lender will offer to you when you begin searching for your dream home. During the pre-approval process, you’ll learn the maximum mortgage you qualify for, an estimate of your monthly payments, and an estimate of your interest rate.

Once your pre-approval is complete and you are under contract on a new home, you will have the option of locking in your interest rate. Interest rate locks are generally from 15 to 120 days, depending on how much time you will need to close on your new home. If rates increase during your loan process and after you lock in your rate, you will still get the promised rate.

It is recommended to complete pre-approval before you make an offer on a house. This helps you determine the amount a lender will lend to you and if you are comfortable with the associated monthly payment. It also puts you in a much stronger position with a seller or against other offers on the same home.

What are the different types of mortgages?

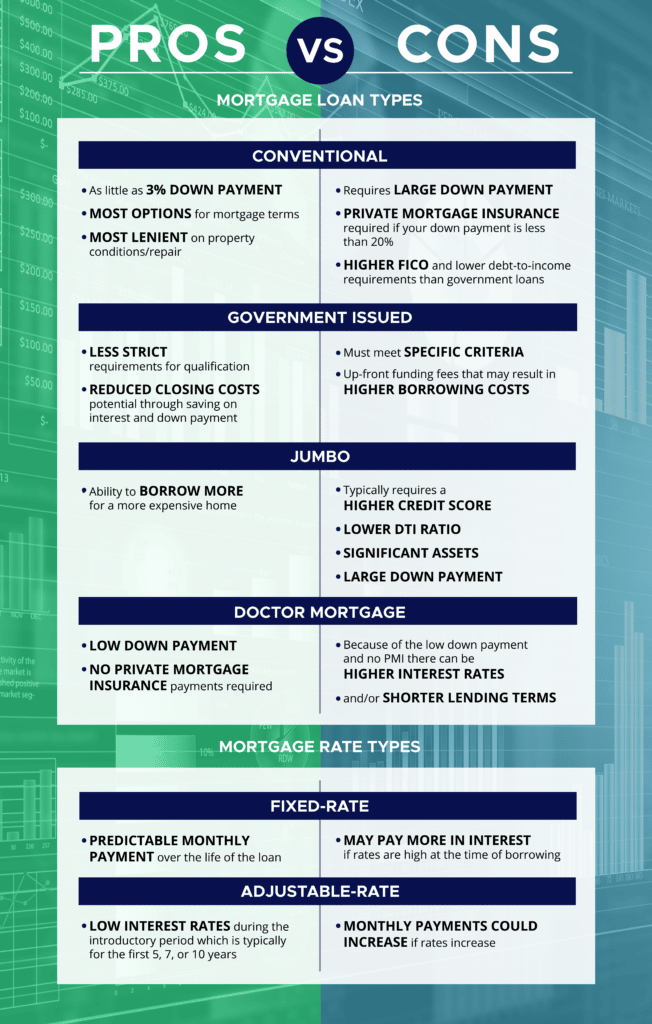

The three main types of mortgages are conventional, government or jumbo. Depending on the type, you may have a fixed or adjustable-rate loan.

- Conventional mortgages are the most common type of mortgage. These loans can have stricter credit score and debt-to-income (DTI) requirements.

- Government-issued loans are insured by government agencies and include FHA, USDA and VA loans. You may be able to qualify for a government-backed loan even if you can’t get a conventional loan as they generally allow for lower FICO requirements and higher debt-to-income limits.

- Jumbo loans are used for buying high-value property and can be more difficult to qualify for than other mortgage types. Jumbo loans are mortgage loan amounts that exceed the conforming loan limit for the area in which you wish to buy. (Most of the country has a conforming loan limit of $726,200 for a 1-unit property).

- Bonus: Doctor loans are mortgages built specifically for doctors — physicians, dentists and veterinarians. These loans have lower down payments that could help a doctor purchase a home before they would otherwise be able to.

- Fixed-rate loans offer a very predictable monthly payment because they have the same interest rate and principal-to-interest payment each month.

- Adjustable-rate loans have interest rates that change with market changes. You will have a fixed-rate for introductory period. After that period, if the market index increases, your rate will rise; if it decreases, your rate could lower. The amount that an adjustable rate, or ARM, could rise or fall depends on the floor, or ceiling of that mortgage loan.

What does it mean to refinance a mortgage loan?

Refinancing a mortgage means you get a new mortgage loan to replace your current one. Refinancing could benefit you by lowering your interest rate, reducing your payments, changing your loan type, shortening your loan term, or providing cash for things like home improvements or debt consolidation.

How do you find the best mortgage lender for doctors?

Choosing a mortgage lender is a big decision. You will be paying this loan and working with this lender for the next few decades, so it is important to feel comfortable with the lender and know they are able to help if a need arises.

When looking for a lender, consider different places like banks, credit unions, online lenders and more. Compare their rates, loan terms, down payment requirements, fees and more.

Doctors have unique needs, so there are some other factors that physicians, dentists and veterinarians may want to consider. The best mortgage loans for doctors are those that truly keep those needs in mind like unusual work schedules, high debt loads and unique financial life cycles.

Some lenders understand that early career doctors don’t have the savings to dedicate to a sizable down payment and offer 100% financing.

Need help finding a home or thinking about a mortgage?

Finding your dream home or the right mortgage to finance your dream home can be difficult, but a team behind you can make it a little easier. Our Build Your Team program can get you connected to real estate agents and financial advisors to help you throughout the process. Get connected for free by visiting our page here.