High-Balance Deposits Secured by the FDIC

Insure balances up to $125 million per tax ID, for free!

High Balance Deposits Secured by the FDIC

Insure balances up to $125 million per tax ID, for free!

Protect Your Deposits With Extended Coverage

Higher deposit balances require more protection! The FDIC protects up to $250,000 per depositor per insured bank for each account ownership category.

Panacea offers a free program to protect your deposits above $250,000, for both your consumer and commercial accounts. Talk to a banking specialist today!

Digitally Streamlined Application Process

Fast Access to Protection

Concierge Support, 24/7/365

Protect Your Deposits With Extended Coverage

Panacea offers a free program to protect your deposits above $250,000, for both your consumer and commercial accounts. Talk to a banking specialist today!

Digitally Streamlined Application Process

Fast Access to Protection

Concierge Support - 24/7/365

We understand the busy schedule of a doctor, because we are doctors. That is why we have developed a fully digital application designed to streamline the application process and are committed to providing expedited decisions that you won’t experience at traditional banks.

Insured Cash Sweep - For Balances Above $250,000

Insured Cash Sweep - Insuring Your Deposits

Insure Your Money

Insured Cash Sweep (ICS) accounts protect your deposits, up to $125 million per tax ID. Whether you have money in personal or business accounts, you get it protected today.

Access Funds

Make unlimited withdrawals on any business day using the ICS demand option.

Earn Interest

Put excess cash balances to work by placing funds into demand deposit accounts using the ICS demand option, or into savings accounts using the ICS savings option.

Rest Assured

Make large deposits eligible for multi-million dollar FDIC insurance. This protection is back by the full faith and credit of the federal government.

Save Time

Works directly with your Panacea Financial accounts, so you can track account activity, balances, and other information online. Set up electronic statements from a single acocunt, rather than multiple banks or accounts.

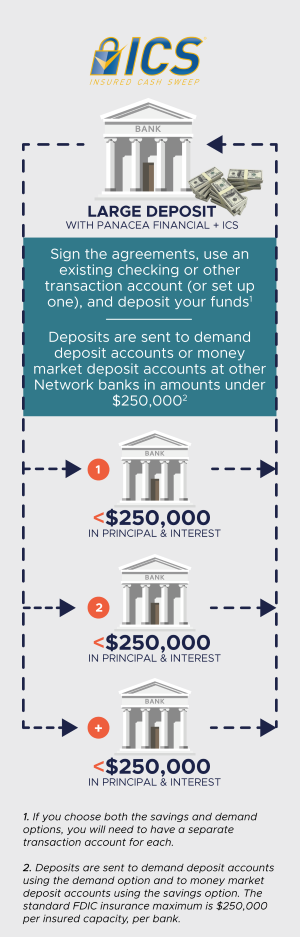

How ICS Protects Your Deposits

Video: How ICS Works

FAQs

ICS (Insured Cash Sweep) is a method of offering our retail and commercial clients additional FDIC insurance, over and above the $250,000 FDIC insurance per Tax ID or Social Security Number.

ICS pools Primis' FDIC Insurance with that of other banks. For example, if Jane Doe has $500,000 with Primis, all balances above $250,000 would not be insured by the FDIC. If ICS were used to insure Ms. Doe’s funds, then the additional $250,000 would be ‘pooled’ with that of another bank, in exchange for Primis doing the same thing. For more information, see our resource article.

Money Markets, CDs, Savings Accounts, and DDAs (in certain cases) can all be collateralized.

Once the contracts are signed, your funds are typically fully protected within the next 3-5 business days.

As a service to our customers, Panacea offers this completely free on checking account balances over $250,000. For savings account balanes over $250,000 the ICS program reduces the savings rate by 0.125%.

Typically we see this used on accounts about $250,000, although we can establish this at lower dollar amounts if you think your deposits will grow above the amount protected by the FDIC.

Panacea Financial is a division of Primis, Member FDIC.

- $25 minimum opening deposit. Cannot transfer balances from existing accounts. ATM Refunds of foreign transactions will be refunded within five business days after the statement cycle ends. External wire fees refunded up to $35 per wire for a wire over $10,000.

- APY = Annual Percentage Yield. The advertised APY is effective 2/23/2023 and subject to change thereafter. No minimum balance required to obtain the APY. The minimum to open a Panacea Savings Account is $25. Fees may reduce earnings. Offer is subject to change without notice and may be withdrawn at any time. Up to six transfers or withdrawals per statement cycle.

- FDIC Insurance limit is $250,000, per depositor, per ownership category.

Placement of your funds through the ICS service is subject to the terms, conditions, and disclosures set forth in the agreements that you enter into with us, including the ICS Deposit Placement Agreement. Limits and customer eligibility criteria apply. Program withdrawals are limited to six per month when using the ICS savings option. ICS, Insured Cash Sweep, and Bank Safe, Bank Smart are registered service marks of Promontory Interfinancial Network, LLC.